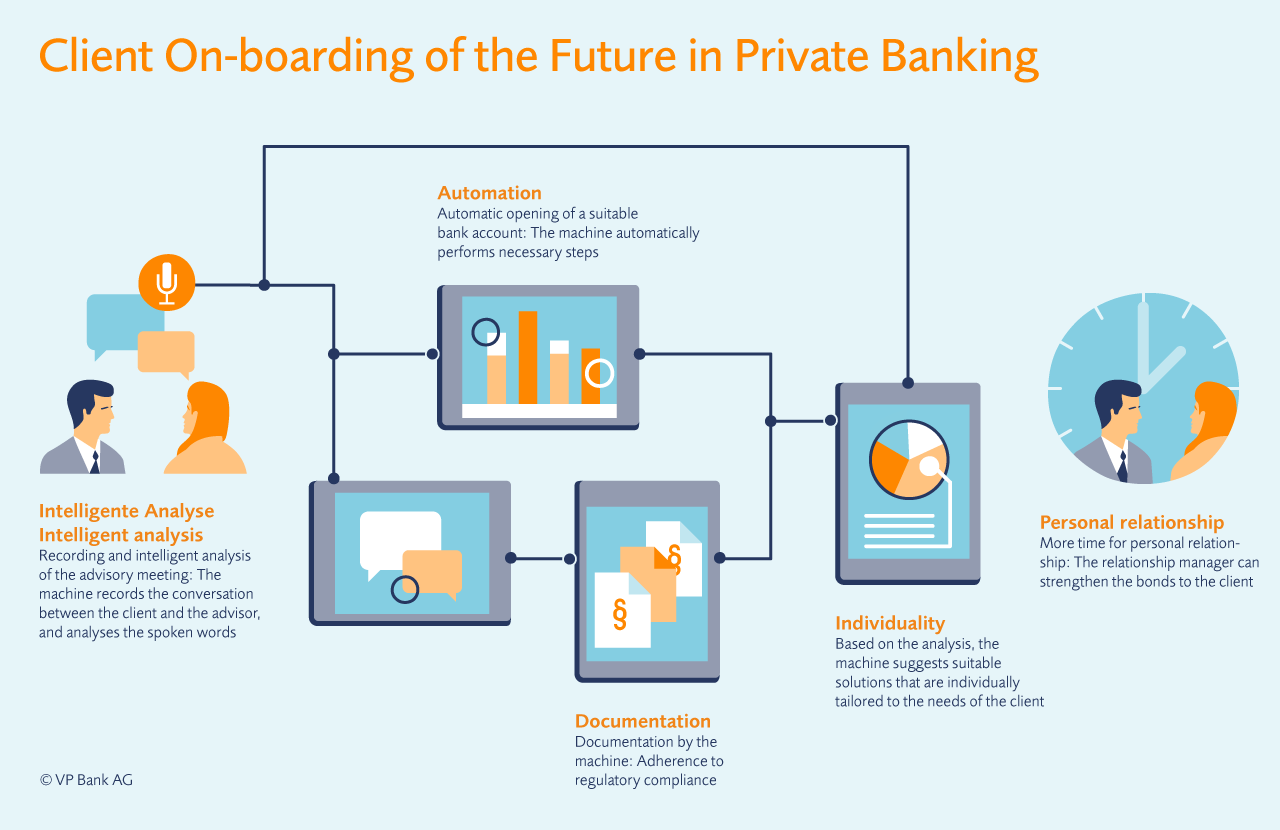

As technology continues to advance, the banking industry is experiencing a rapid transformation with the rise of automation. Banking automation refers to the use of innovative technological solutions to streamline and enhance various banking processes. From simple tasks like cash withdrawals and deposits to more complex operations like loan approvals and account management, automation is revolutionizing the way banks operate and interact with their customers.

One of the key advantages of banking automation is its ability to unlock greater efficiency. By automating routine processes, banks can reduce the time and effort required to carry out these tasks, allowing their staff to focus on more value-added activities. This improved efficiency not only benefits the banks themselves, but also their customers, who can enjoy faster and more seamless service. Additionally, automation can help minimize errors and improve accuracy, ensuring that transactions are processed correctly without the risk of human error.

Banking automation solutions come in various forms, including online and mobile banking platforms, digital payment systems, and self-service kiosks. These solutions offer customers the convenience of accessing their accounts and conducting transactions from anywhere, at any time. This not only saves customers valuable time but also provides them with greater control and flexibility over their finances.

In this guide, we will explore the future of banking automation, delving into the cutting-edge technologies and emerging trends that are shaping the industry. We will examine the benefits and challenges of implementing automation solutions, and provide insights on how both banks and customers can leverage these advancements to their advantage. So let’s dive in and uncover the exciting possibilities that lie ahead in the world of banking automation.

Benefits of Banking Automation

Increased efficiency: Banking automation has the ability to streamline and optimize various banking processes, leading to increased efficiency. By automating routine tasks, such as data entry and customer inquiries, banks can save time and resources, allowing employees to focus on more complex and value-added activities. This not only improves productivity but also enhances the overall customer experience.

Enhanced accuracy: Manual errors can cost banks significant time and money. However, by implementing automation solutions, banks can reduce the risk of human errors and improve the accuracy of their operations. Automation eliminates the need for manual data entry, minimizing the chances of mistakes caused by manual input. With fewer errors, banks can provide more reliable and trustworthy services to their customers.

Improved customer service: Automation in banking enables faster and more efficient customer service. Tasks such as account opening, transaction processing, and loan applications can be expedited through automation, resulting in shorter wait times for customers. Additionally, automation allows banks to provide round-the-clock service, reducing the need for customers to wait for business hours. This 24/7 accessibility enhances customer satisfaction and loyalty.

Overall, banking automation offers numerous benefits, including increased efficiency, enhanced accuracy, and improved customer service. By leveraging automation solutions, banks can stay ahead in the modern banking landscape and provide better services to their customers.

Types of Banking Automation Solutions

There are several types of banking automation solutions that have emerged in recent years. These solutions aim to streamline banking processes, increase efficiency, and provide customers with a seamless banking experience. In this section, we will explore three types of banking automation solutions: robotic process automation (RPA), chatbots, and self-service kiosks.

Robotic process automation (RPA) is a technology that uses software robots to automate repetitive and rule-based tasks within the banking industry. These robots are designed to mimic human actions and can perform tasks such as data entry, transaction processing, and report generation. By automating these repetitive tasks, RPA enables banks to reduce errors, improve speed and accuracy, and free up human employees to focus on more complex and customer-centric tasks.

Chatbots, also known as virtual assistants or AI-powered conversational agents, are another type of banking automation solution. These intelligent bots are capable of understanding and responding to customer queries and requests in real-time. Chatbots can handle a wide range of banking-related inquiries, such as account balance inquiries, transaction history requests, and even provide personalized financial advice. By leveraging natural language processing and machine learning algorithms, chatbots offer customers a convenient and efficient way to access banking services and information, 24/7.

Self-service kiosks have become increasingly common in the banking industry, providing customers with quick and easy access to various banking services. These kiosks allow customers to perform tasks such as depositing checks, withdrawing cash, transferring funds, and printing statements, without the need for assistance from a human teller. By enabling self-service transactions, banks can reduce wait times, increase customer satisfaction, and optimize their operational efficiency.

In conclusion, banking automation solutions such as robotic process automation (RPA), chatbots, and self-service kiosks have revolutionized the banking industry. These technologies offer numerous benefits, including enhanced efficiency, improved customer experience, and cost savings. As banks continue to embrace automation, we can expect to see further advancements in banking technology, paving the way for a more streamlined and automated future.

Challenges in Implementing Banking Automation

Implementing banking automation can bring numerous benefits to financial institutions, but it is not without its challenges. This section will explore some of the key obstacles that often arise during the implementation process.

Integration Complexity: One of the main challenges in implementing banking automation is the complexity of integrating new automated systems with existing infrastructure. Financial institutions often have legacy systems in place that were not designed to seamlessly work with modern automation solutions. This integration complexity can lead to delays and increased costs as banks need to ensure that all systems can effectively communicate and share data.

-

Security Concerns: As automation involves handling sensitive financial data, security is a paramount concern. Cybersecurity threats are evolving at an alarming pace, and banks must continuously stay ahead of these threats to ensure the safety of their customers’ information. Implementing robust security measures within automated systems and conducting regular audits and tests for vulnerabilities are necessary but can be time-consuming and resource-intensive.

-

Resistance to Change: Embracing automation often requires a cultural shift within the organization. Employees may feel apprehensive about the potential impact of automation on their roles and job security. Change management and effective communication become vital in addressing these concerns and ensuring that employees are aligned with the automation initiatives. Additionally, providing adequate training and support to employees to navigate the new automated processes is crucial for successful implementation.

Despite these challenges, it is important to recognize that banking automation offers significant advantages in terms of efficiency and accuracy. By acknowledging these obstacles and proactively addressing them, financial institutions can successfully overcome implementation challenges and unlock the potential of automation in the banking sector.