Imagine you are inviting me into the cozy living room of your mind, where you long to learn about the power of home insurance. Picture us sitting on a soft, plush sofa, surrounded by the warmth of knowledge and insight. Today, we embark on a journey to unveil the secrets that lie within the realm of home insurance, as we discover how it can shield your humble abode from the unexpected storms of life.

In this comprehensive guide, we will unravel the intricate tapestry of home insurance, empowering you with the knowledge to protect your most cherished possessions. Together, we will navigate the labyrinthine policies and decipher the cryptic jargon, arming you with the tools to make informed decisions that safeguard your beloved home.

So, my eager friend, buckle up and prepare to delve deep into the world of home insurance. Together, we will embark on a voyage that will forever change the way you view and secure your shelter. Let us unlock the riches of knowledge and wisdom, as we illuminate the path to comprehensive home protection. Are you ready? Let us begin.

Section 1: Understanding Home Insurance

Home Insurance serves as a protective shield for your most valuable asset – your home. It provides financial security against unexpected events like natural disasters, theft, or accidents that can result in damage to your property. By investing in home insurance, you can ensure that your home, possessions, and peace of mind are safeguarded.

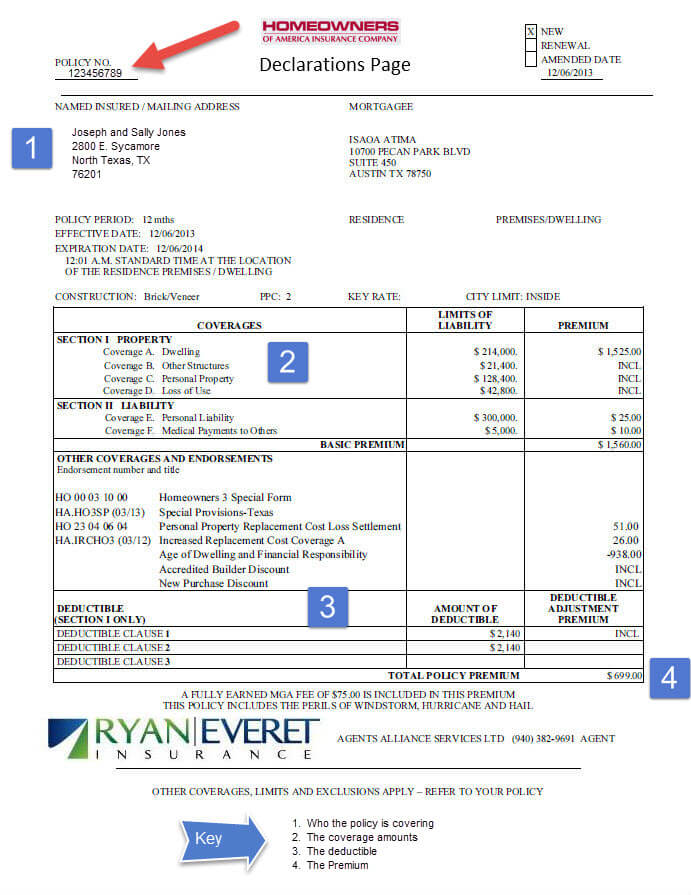

Home insurance functions as a contract between the homeowner and the insurance company. In exchange for regular premium payments, the insurance company agrees to provide coverage for specified risks outlined in the policy. These risks often include fire, theft, vandalism, and certain natural disasters, depending on the policy type and coverage level chosen.

When exploring home insurance options, it is essential to understand the different types of coverage available. Two common categories of coverage are building insurance and contents insurance. Building insurance protects the physical structure of your home, including the walls, roof, and fixtures. On the other hand, contents insurance covers the belongings inside your home, such as furniture, electronics, and personal possessions.

By carefully assessing your needs and selecting appropriate coverage, you can ensure that your home insurance policy adequately protects both the structure and contents of your home. Understanding the specifics of your policy and its coverage limits will enable you to make informed decisions and be prepared for any unforeseen circumstances that may arise.

Remember, home insurance is not only about financial protection, but also about gaining peace of mind. It offers a sense of security, knowing that you are covered in the face of unexpected events. In the following sections of this guide, we will delve deeper into the different aspects of home insurance, providing you with essential knowledge to make the best decisions for your home and loved ones.

Section 2: Benefits of Home Insurance

-

Financial Protection:

Home insurance provides valuable financial protection for homeowners. In the event of unexpected incidents such as natural disasters, fires, or theft, having the right insurance coverage can help alleviate the financial burden. It ensures that you are not left with the hefty repair or replacement costs on your own, providing a sense of security and peace of mind. With home insurance, you can confidently face unforeseen circumstances knowing that your financial assets are protected. -

Property Coverage:

One of the key benefits of home insurance is the coverage it offers for your property. Whether it is your house, the contents inside, or other structures on your property such as a shed or garage, home insurance can provide coverage for damages or losses resulting from covered perils. This includes protection against fire, storms, vandalism, and more. Should any covered perils occur, your insurance policy will help cover the costs of repairing or replacing damaged property, minimizing your out-of-pocket expenses. -

Liability Protection:

Home insurance not only protects your property but also provides liability coverage. Accidents can happen anytime, and if someone gets injured while on your property, you may be held legally responsible for their medical bills or any other damages. Home insurance can help protect you against such liability claims, covering the associated legal expenses and potential settlement costs. This liability protection extends beyond your home, offering coverage even if the accident occurs elsewhere, such as a dog bite incident at a park.

Remember, each insurance policy varies in terms of the coverage it offers, so it is essential to carefully review your specific policy to understand the extent of the benefits provided. By securing a comprehensive home insurance policy, you can shield your home and enjoy the peace of mind that comes with knowing you have the necessary protection in place.

Section 3: Choosing the Right Home Insurance Policy

When it comes to choosing the right home insurance policy, there are a few key factors to consider.

Firstly, it’s important to evaluate the coverage options available to you. Different insurance policies may offer varying levels of protection, so take the time to understand what each policy covers and determine which one aligns with your needs and budget.

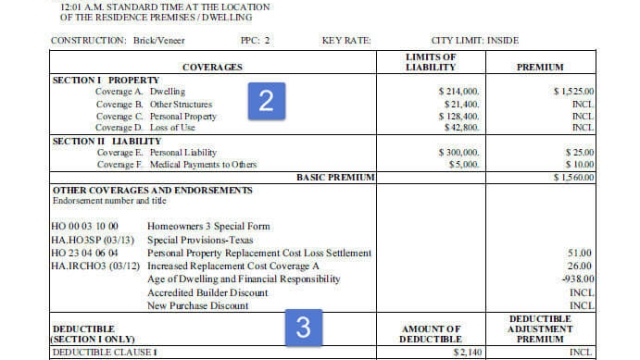

Secondly, consider the deductible amount associated with each policy. A deductible is the amount of money you have to pay out of pocket before your insurance coverage kicks in. Keep in mind that a higher deductible usually results in a lower premium, but it also means you’ll have to pay more in the event of a claim.

Lastly, take into account the reputation and customer service of the insurance providers you’re considering. Look for insurance companies that have a strong track record of reliability and excellent customer support. Reading reviews and seeking recommendations from friends or family can be helpful in making an informed decision.

In conclusion, choosing the right home insurance policy requires careful consideration of coverage options, deductible amounts, and the reputation of insurance providers. By taking the time to research and compare different policies, you can ensure that you shield your home effectively with the right insurance coverage.